Instacash: Get Cash Advances Up To $500 | Fees, Benefits & More

Are you constantly finding yourself short on cash between paychecks, juggling bills, and desperately wishing for a financial lifeline? Instacash, an optional service offered by MoneyLion, promises to provide that very lifeline, offering quick access to funds without the hassle of traditional loans. But does it live up to the hype, and is it the right solution for your financial needs? Let's delve into the intricacies of Instacash, exploring its benefits, fees, and user experience to determine if it's a viable option in the ever-evolving landscape of financial technology.

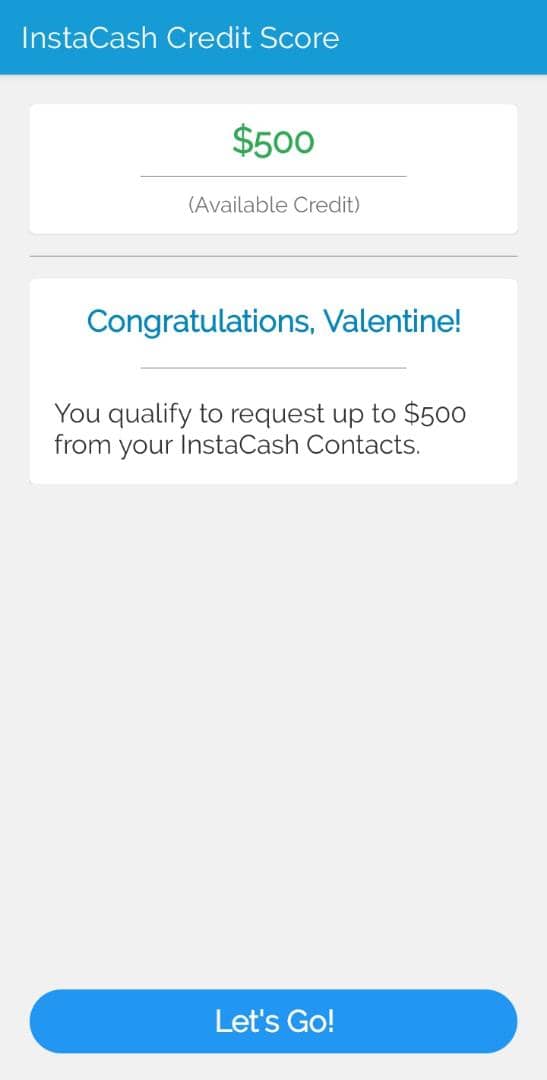

MoneyLion's Instacash cash advance offers users advances up to $500, or $1,000 for members. This service, available through the MoneyLion mobile app, allows users to access a $5 to $100 advance on their monthly payment, providing a potential buffer against unexpected expenses or short-term financial needs. The appeal is immediate: a quick infusion of cash without the lengthy application processes or credit checks associated with conventional loans. But like any financial product, a closer examination is warranted. The available Instacash advance limit is displayed within the MoneyLion mobile app, and this limit can change from time to time. These changes are determined by your direct deposits, account transaction history, and other factors as determined by MoneyLion. Forbes Advisor notes that "Instacash allows you to borrow up to 30% of your recurring cash direct deposit per pay cycle with no credit check," illustrating a system where your borrowing power is directly linked to your income stream. For example, as detailed by Forbes, if you have a $700 biweekly deposit, your advance will be $210.

To fully understand Instacash, consider this breakdown:

| Feature | Details |

|---|---|

| Provider | MoneyLion |

| Service Type | Cash Advance |

| Advance Amount | Up to $500 for standard users, up to $1,000 for MoneyLion members. |

| Eligibility | Based on direct deposits, account history, and other factors determined by MoneyLion. |

| Fees | Turbo fees may apply, plus optional tips. |

| Repayment | Generally, scheduled on your next direct deposit date. |

| Credit Check | None |

| Legal Obligation to Repay | While there is no legal obligation, you will not be eligible to request a new advance until your outstanding balance is paid. |

| Repayment calculation example | For a $40 Instacash advance with a turbo fee of $4.99 and a $3 tip, your repayment amount will be $47.99. |

| Repayment calculation example | For a $40 Instacash advance with a turbo fee of $4.99, your repayment amount will be $44.99. |

| Other details | If the apps algorithm fails to set a repayment date based on your payday, the app will set the repayment date as the second Friday after the Instacash request. |

| Headquarters | New York, NY (launched in 2013). |

| Official Website | MoneyLion Official Website |

The financial technology landscape is crowded with alternatives, each vying for the attention of consumers seeking short-term financial solutions. Instacash competes with other cash advance apps, each offering a unique value proposition. Examining the user experience is essential to determining whether Instacash is the right fit. The app interface is designed to be user-friendly, with clear instructions and easy navigation. The process of requesting an advance is streamlined, minimizing the time and effort required to access funds. When you request an Instacash SM advance, three factors affect your cycle repayment amount: the amount of your base advance, your choice of delivery, and any optional tips or turbo fees. However, some users might encounter potential drawbacks, such as the turbo fee or the potential for a repayment date that may not align with their income cycle.

One of the core aspects of Instacash is its fee structure. MoneyLion is transparent about the fees associated with the service. While Instacash advances are offered without interest, users may be charged a turbo fee for faster access to funds. It is crucial to consider these fees when assessing the overall cost of borrowing, as they can significantly impact the total repayment amount. For instance, a $40 Instacash advance with a turbo fee of $4.99 will result in a repayment amount of $44.99. Additional fees can be added. For a $40 Instacash advance with a turbo fee of $4.99 and a $3 tip, your repayment amount will be $47.99. Its important to consider the cumulative effect of these fees, especially if you rely on Instacash frequently.

Repayment terms are also a key factor in understanding Instacash. Generally, the scheduled repayment date is tied to your next direct deposit date. This arrangement offers a degree of predictability, aligning repayment with your income cycle. However, the flexibility of this repayment schedule could be tested if your direct deposit schedule is irregular or unpredictable. Moreover, while there is no legal obligation to repay an advance, it's important to recognize the implications of not meeting your repayment obligations. You will not be eligible to request a new advance until your outstanding balance is paid.

For users in New York, specific legal considerations apply. If MoneyLion has, directly or indirectly, charged, taken, or received interest at rates that exceed an annualized cost of sixteen percent (16%), legal repercussions can follow. This is an important consideration for New York residents, ensuring that they understand the regulations and legal implications associated with using the service. Further, the company's conduct may be subject to regulatory scrutiny, as indicated by references to violations of Executive Law 63(12). The implications of such conduct could include legal actions and potential financial penalties. It is a complex subject requiring thorough research and an understanding of state and federal regulations.

MoneyLion, the company behind Instacash, was launched in 2013, with its headquarters based in New York. The companys commitment to corporate social responsibility (CSI) is a critical aspect of understanding its overall approach. Investigating the companys values and how it approaches financial services is crucial to getting a clear understanding. Contacting the support team via the provided channels such as info@instacash.co.sz, or by phone at +268 7936 5000, or via the toll-free call center at 365 +268 2404 7251 offers a way to get direct answers and to delve deeper into the operation of the Instacash service.

The service offered by Instacash allows you to borrow up to a certain percentage of your recurring cash direct deposit per pay cycle. This differs from traditional loans and offers a convenient way to access funds. The company is designed to provide services that ease the financial burden. The appeal is undeniable: fast access to funds when you need it most. It is important to have a firm grasp of the implications of these types of services. While Instacash provides a way to mitigate the shortfalls, it comes with fees and a need to be repaid. The financial benefit will depend on your situation, the frequency of use, and your capacity to repay the advances.

One must consider alternatives such as checking early payday, direct deposit time with other financial institutions. It is critical to explore the options and ensure your financial strategy aligns with your income cycle and financial needs. Instacash, with its no-credit-check approach and promise of rapid access to funds, is an attractive proposition for many. Understanding its mechanics, weighing the benefits against the costs, and comparing it with other options is crucial for making informed decisions.

In conclusion, Instacash offers a compelling proposition for those seeking a quick and convenient financial bridge. It is an optional service offered by MoneyLion that offers cash advances up to $500 with no interest or credit check. However, like all financial products, understanding the terms, fees, and repayment obligations is paramount. Whether Instacash is the right solution for you hinges on a careful evaluation of your financial needs, income patterns, and willingness to manage repayment responsibly. Ultimately, the decision to use Instacash is a personal one, requiring a thorough understanding of its features and a commitment to responsible financial behavior.